FICCI’s latest quarterly survey on manufacturing assessed recovery of the sector for Q-3 (October-December 2020-21) and pointed that it is expected to regain the lost momentum in the Q-4.

The percentage of respondents reporting higher production in the third quarter of 2020-21 had increased vis-a-vis the Q-2 of 2020-21. The proportion of respondents reporting higher output during October-December 2020 rose to 33 per cent, as compared to 24 per cent in Q-2 of 2020-21. The percentage of respondents expecting low or same production is 67 per cent in Q-3 2020-21 which was 74 per cent in Q-2 2020-21.

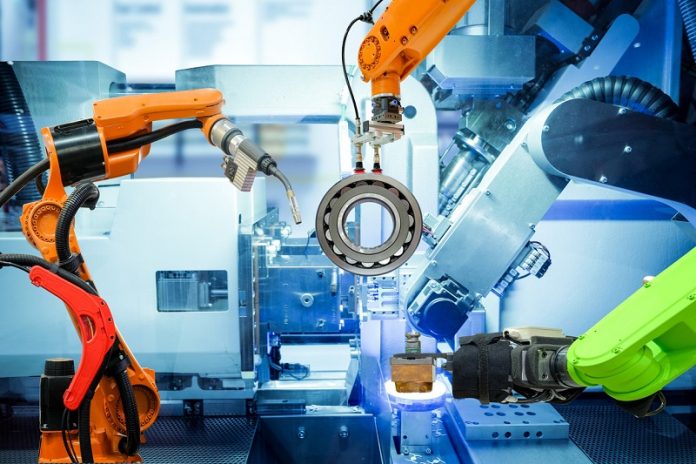

FICCI’s survey assessed the sentiments for the next quarter (Q-4) for 12 major sectors namely automotive, capital goods, cement and ceramics, chemicals, fertilizers and pharmaceuticals, electronics and electricals, leather and footwear, medical devices, metal & metal products, paper products, textiles, textile machinery, and miscellaneous. Responses have been drawn from over 300 manufacturing units from both large and SME segments with a combined annual turnover of around Rs 5.3 lakh crore.

As per the survey, the overall capacity utilization in manufacturing has witnessed a rise to 74 percent as compared to 65 percent in the previous quarter. The future investment outlook, however, looks slightly better as 30 per cent of respondents reported plans for capacity additions for the next six months as compared to 18 per cent in the previous quarter.

High raw material prices, high cost of finance, shortage of skilled labor and working capital, high logistics cost, low domestic and global demand due to imposition of lockdown across all countries to contain the spread of coronavirus, excess capacities due to high volume of cheap imports into India, lack financial assistance, uncertain demand scenario across globe, complex procedures for obtaining environmental clearances, high power tariff, are some of the major constraints which are affecting expansion plans of the respondents.

The survey indicated that capacity utilization witnessed a jump in Q3 for automotive, capital goods, electronics and electrical, medical devices sectors such hike it remained slow or subdued in textile and leather sectors.

Besides, 78 percent of the respondents had either more or the same level of inventory in October-December, whereas around 79 percent of the respondents maintained either more or the same level of inventory in the July-September 2020 quarter of 2020-21.

The percentage of respondents expecting an increase in exports has increased substantially to 29 per cent when compared to previous quarters during the lockdown period, wherein 24 per cent of respondents were expecting a rise in exports. Also, 34 percent are expecting exports to continue to be on the same path as that of the same quarter last year.

The hiring outlook for the sector also seems to be improving, as 37 per cent against 20 per cent in the previous quarter are planning to hire additional workforce.

Based on expectations in different sectors, sectors such as Medical Devices, Chemicals, Fertilizers and Pharmaceuticals, Textile Machinery, Electronics and Electricals, Capital Goods and Metal and Metal Products are likely to register strong growth in Q-3 2020-21, the survey indicated.