The Finance Ministry of India announces a huge reduction in GST for electronics items on the sixth anniversary of the GST implementation on 1st July.

The Union Finance Ministry recently made an announcement regarding a reduction in Goods and Services Tax (GST) on the purchase of electronic items. This decision aims to provide relief to customers and make these purchases more affordable. On the 6th anniversary of the implementation of GST, the government released a list of items that will have reduced GST rates.

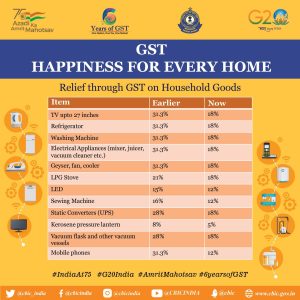

Previously, customers had to pay a GST of 31.3 percent on electronic items such as TVs up to 27 inches, refrigerators, washing machines, geysers, fans, coolers, and electrical appliances like mixers, juicers, and vacuum cleaners. However, the new list lowers the GST rates on these items to 18 percent.

Furthermore, the GST rate on mobile phones has been reduced from 31.3 percent to 12 percent. Consequently, mobile phone companies will also decrease the prices of their products.

The implementation of GST laws by the central government on July 1, 2017, was a significant milestone in streamlining India’s tax system. It replaced the complex network of taxes with a simplified framework consisting of distinct tax slabs of 5 percent, 12 percent, 18 percent, and 28 percent for goods and services.

In other news, the gross goods and services tax (GST) revenue collection in India for the month of June reached Rs 1,61,497 crore, showing a 12 percent increase compared to the revenue collected in the same month last year, according to the Ministry of Finance. The gross GST revenue collected in June 2023 includes CGST of Rs 31,013 crore, SGST of Rs 38,292 crore, IGST of Rs 80,292 crore (including Rs 39,035 crore collected on import of goods), and cess of Rs 11,900 crore (including Rs 1,028 crore collected on import of goods). The government has settled Rs 36,224 crore to CGST and Rs 30,269 crore to SGST from IGST. After the regular settlement, the total revenue for the Centre and the States in June 2023 is Rs 67,237 crore for CGST and Rs 68,561 crore for SGST.

This marks the fourth time that gross GST collection has crossed the Rs 1.60 lakh crore mark. The average monthly gross GST collection for the first quarter of FY22, FY23, and FY24 is reported as Rs 1.10 lakh crore, Rs 1.51 lakh crore, and Rs 1.69 lakh crore, respectively.