Although sales sentiment around electronic components took a dip in April, strong demand from critical end markets is expected to improve things in May.

In its April Electronic Component Sales Trend (ECST) survey, the ECIA saw sentiment decline by 1.9 points from March to remain below the growth threshold of 100.0. However, the outlook for May is considerably brighter as expectations jump above 99, almost to the breakeven level, according to Dale Ford, ECIA chief analyst.

ECIA expects a strong improvement in May driven by demand from some key end markets. Healthy results for electronics end markets are broad based, ECIA reported. The automotive, industrial, military/aerospace, and medical markets all show sentiment above 100 in May. Overall, lead time trends remain stable

Similar end-market trends were seen in the IPC’s April Supply Chain Sentiment report. The industry expects the military sector will grow 16 percent on average this year, followed by the aerospace sector and the communications sector which are both expected to grow by roughly 11 percent. The medical sector is expected to rise 10 percent.

The automotive sector and industrial electronics sector are both expected to rise 5.6 percent. The consumer electronics sector is expected to decline 3 percent and the computer sector is expected to decline 7 percent in 2023.

The IPC noted some regional differences in the automotive sector. Eighty-six percent of firms in APAC expect growth, compared with 37 percent in the Americas and 30 percent in Europe.

Supply chain bottlenecks ease:

The Institute for Supply Management noted in its April manufacturing report that the supply chain is positioned for a rebound. Supplier delivery times have improved, lead times are stable and transatlantic freight costs have declined. Demand, however, hasn’t bounced back and the ISM’s manufacturing index has been in contraction territory for six straight months.

“Having invested heavily to de-risk the supply chain over the last three years due to Covid-19, we are looking to reset with a number of our suppliers to reduce inventory, which has grown steadily over that period,” an electronics executive told the ISM. “Lead times are generally coming down, although electronic components are still a concern.”

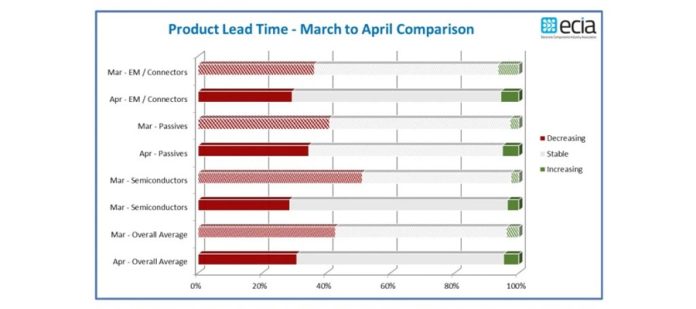

Although the “golden screw” for various electronics projects remains elusive, a majority – 68 percent — of ECIA survey respondents noted semiconductor lead times are stable. More than 60 percent of respondents saw interconnect, passive and electromechanical (EM) lead times stabilize. Overall, declining lead times were seen by 31 percent of survey participants. This is one indicator that supplies, to some extent, are catching up with demand.

May’s encouraging component sales outlook may provide an early indicator that the market decline is easing and could see a turnaround in year-over-year performance before the end of 2023, said ECIA’s Ford. Increased production has been a factor, he added. Given the overall assessment that inventory overhang is the greatest challenge facing the supply chain currently, product mix issues would appear to be the main contributor to any reports of increasing lead times as inventories balance out in the declining market.

If the May 2023 expectations are realized, it would mark the strongest component-sales measurement since May 2022 when a robust result of 117.6 was reported prior to the 20-point drop below the 100 threshold in June.

The passive components sentiment index delivered the strongest results in April with a score of 94. The May prediction for month-to-month sales growth is 104.5. EM components saw sales sentiment decline in April although a strong rebound – to 98.5 – is expected in May.

Semiconductor sentiment only reached a level of 77 percent in April. Only discrete improved. In May, sentiment rises to 94. Only the MCU/MPU subcategory shows declining expectations for May.

The trends reported by the ECST index for semiconductors are fairly consistent with the results reported by WSTS for the Americas, ECIA pointed out. While the worldwide semiconductor market is suffering a “hard landing,” it is fair to say the Americas are achieving a “soft landing” so far, Ford added, in a statement.